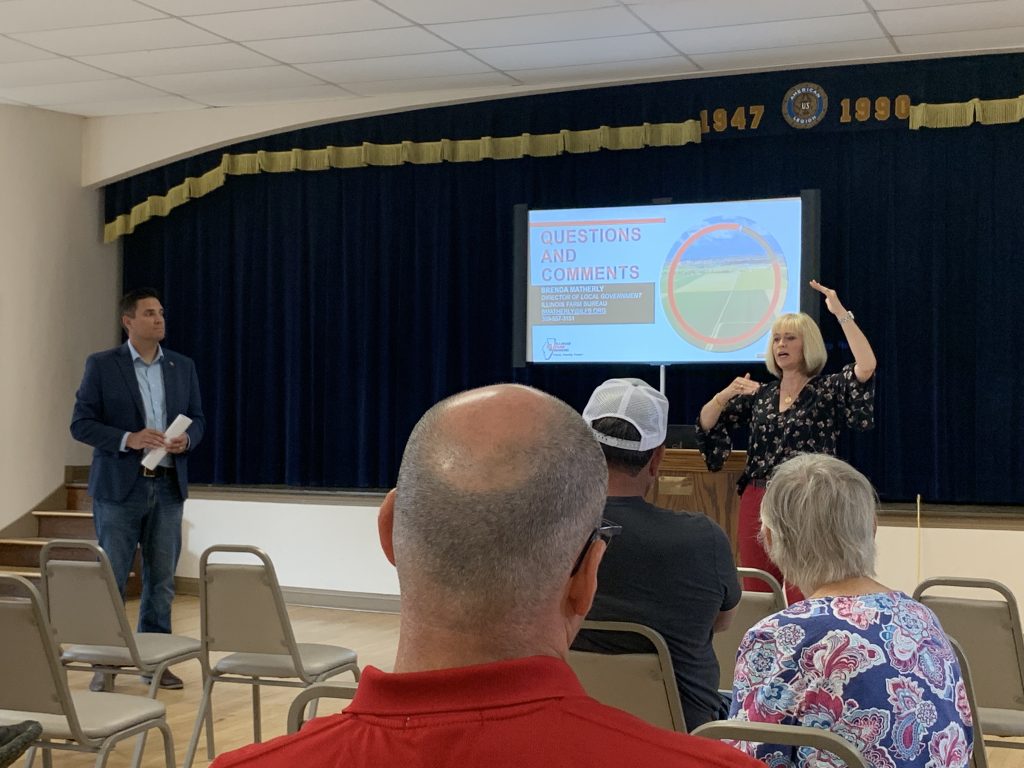

State Representative Adam Niemerg (R-Dieterich) sponsored an assessment seminar for farmers and landowners to learn about how the valuation process works in Illinois for calculating the assessed value of farmland on Thursday in Marshall. Hosted by the Clark County Farm Bureau and held at the American Legion Post 90 in Marshall, farmers from Crawford, Cumberland and Edgar Counties were invited to also attend this regional event.

“Thank you to the Illinois Farm Bureau for conducting this educational seminar for our local farmers to learn how the assessing process works specifically for farmland in Illinois,” said Rep. Niemerg. “I would say everyone who attended learned something about how agricultural land is valued, how there is a 10 percent limit right now either upwards or downwards in the Equalized Assessed Value (EAV) for an acre and that there is a ranking of soil quality from 82 to 130 in Illinois.”

Conducted by the Director of Local Government, Brenda Matherly of the Illinois Farm Bureau, the hour-long presentation covered the history of the property tax in Illinois beginning in 1818 when Illinois became a state, the approach to setting values, the Farmland Assessment Law, and what to expect in the next several years on assessing.

Attendees were able to learn about the assessing process that is established by state law and administered through the state Department of Revenue. From 1818 to 1930, property taxes were calculated on 100 percent of the value of land, but that was lowered to 55 percent of value in the 1930’s, 50 percent of value in 1970, and finally down to 33.33 percent of land value starting in 1975.

“Understanding the assessment process is just one part of the property tax equation and determining what portion of the local levy will ultimately show up on any one property bill,” added Rep. Niemerg. “The plus side to the property tax system in Illinois is that it is collected locally and distributed locally to support things like schools, police and fire departments.”